As Chinese President Xi Jinping visits Kazakhstan this week for Expo 2017 and deepening Shanghai Cooperation Organisation talks in Astana, it is important to understand the underlying state-to-state industrial policies at work beneath the surface.

China’s geo-industrial capacity cooperation policy is reshaping its domestic economic architecture. But for Kazakhstan, and other central Asian economies, Chinese capital in the belt and road strategy is a one-way street, exporting China’s policy as well as its banking and project models, without a reciprocal opening of its consumer or capital markets.

Capacity cooperation is an attempt to bring whole industrial clusters to China’s external markets to develop the industrial bases of its trading partners, while offshoring its cyclical overcapacity problem. The policy was launched in 2015 through the Ministry of Commerce and now pervades every aspect of China’s external industrial policy.

This combination of policy bank loans and industrial overcapacity export is effectively China offshoring its local debt problem to unwitting trading partners

A forthcoming 13th five-year plan for international capacity cooperation will list Kazakhstan as China’s ‘main axis’ to Africa, the Middle East and central Europe. The nature of the industrial cooperation policy is to offshore production clusters. Industries China is offshoring include steel, non-ferrous metals, building materials, chemicals, automotive, agriculture, construction machinery and aerospace technologies. And the intent is to bring in manufactured goods to China from Europe, Africa, the Middle East and central Asian production bases as inputs to a Chinese consumption-driven economy. It is China’s answer to Japan’s APEC (Asia-Pacific Economic Cooperation).

Central funds are distributed to provincial governments, which have their own capacity cooperation policies playing to geographic, industrial infrastructure and competitive advantages. For example Gansu province is paired for investment with Tajikistan, Kyrgyzstan, Turkmenistan, Iran, Kazakhstan, and Azerbaijan, in the fields of mineral resources, non-ferrous metals, and energy. While Qinghai province is paired with Turkmenistan for capacity cooperation in water resources, electricity and textiles.

It has been billed by Beijing not as an outpouring of China’s excess industrial capacity but rather an alternative form of technology transfer and foreign direct investment. As China engineers a state-driven innovation strategy to lift its manufacturing quality up the global value chain, capacity cooperation partners can benefit from taking up the slack in old industries, bringing steel, cement and glass industrial clusters to central Asia.

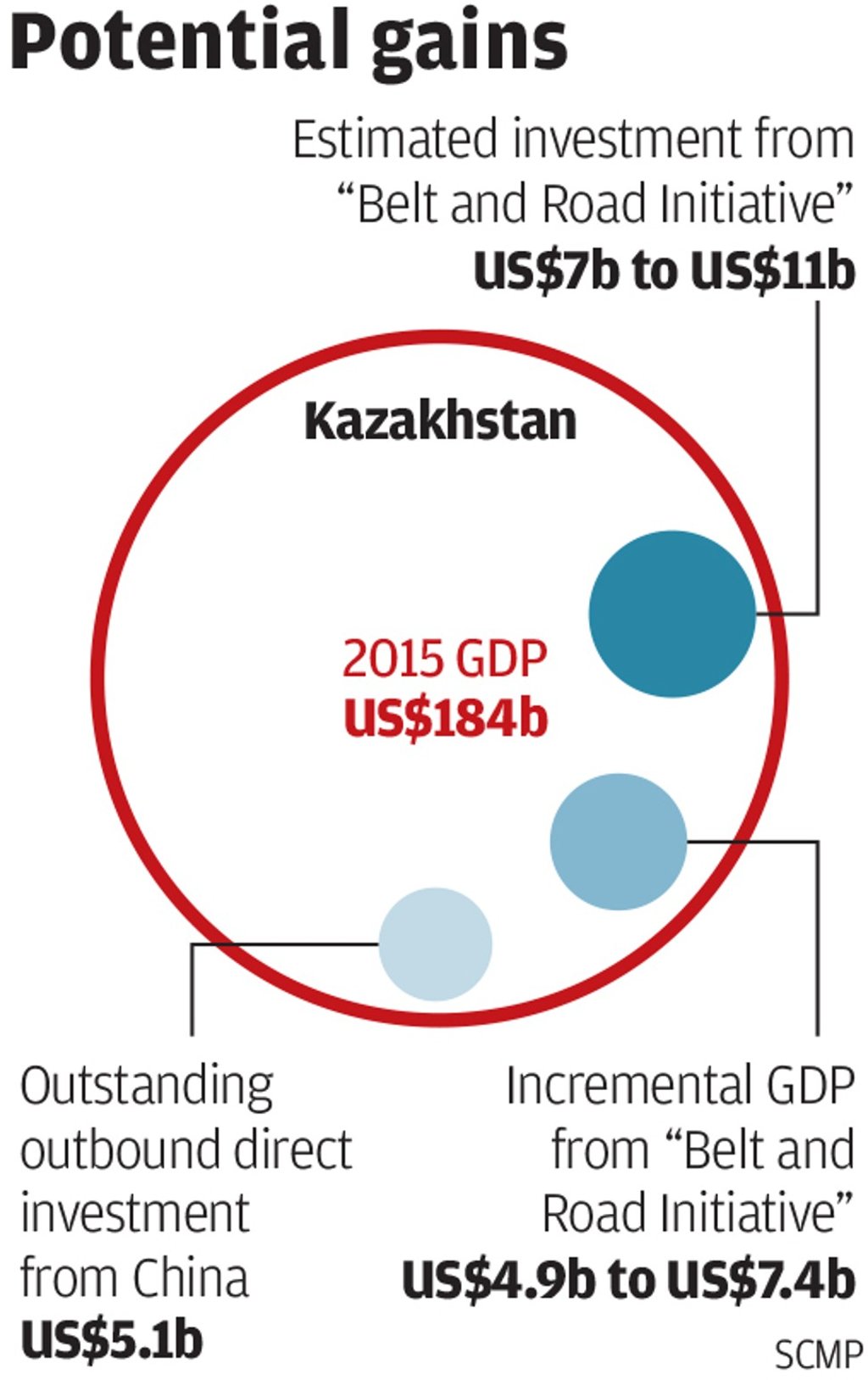

China’s trade and investment strategies for Kazakhsan treat the country as a node within its larger belt and road geo-industrial policy