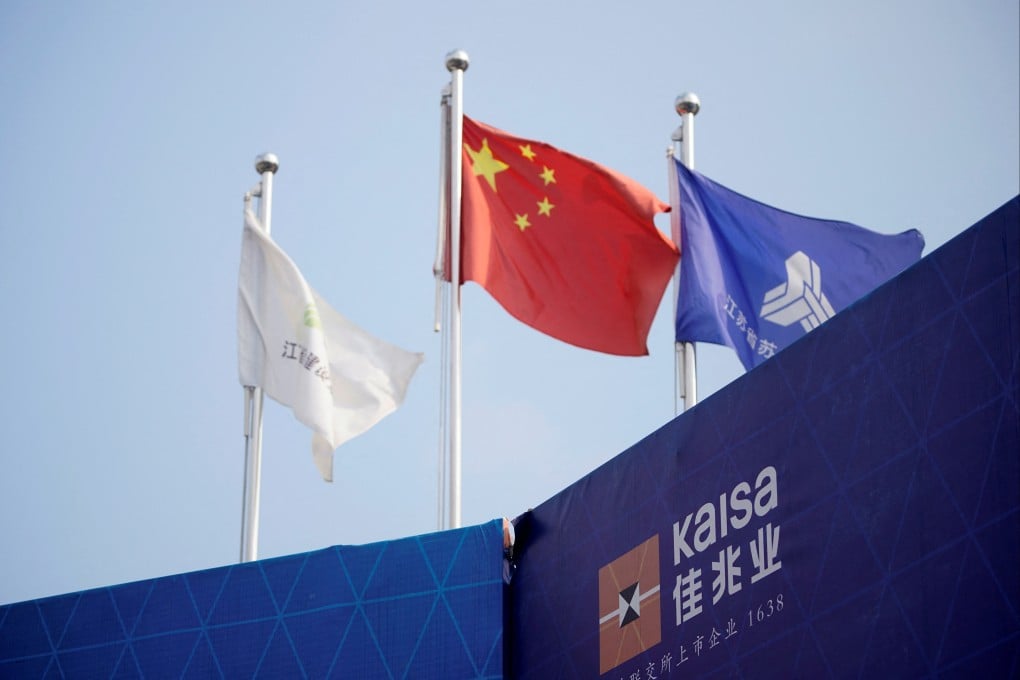

Kaisa shares surge in Hong Kong as majority of creditors support debt restructuring plan

Investors holding more than 75 per cent of its defaulted debts have agreed to support its restructuring terms, filing shows

The stock rose as much as 3.6 HK cents to 12.2 HK cents, before closing at 10.1 HK cents on Tuesday, according to stock exchange data. It has declined 42 per cent this year. The broader market advanced, with the Hang Seng Index rallying 1.4 per cent.

The developer has defaulted on about US$12 billion bonds and other borrowings since 2021, triggered by China’s “three red lines” policy to curb excessive leverage in the industry. Kaisa had also defaulted in 2015, when it became the first Chinese developer to renege on offshore dollar bonds.

Last week, a Hong Kong High Court rescheduled a hearing to wind-up the developer to March 31 next year in a petition that was first initiated by hedge fund Broad Peak Investment in March. Other bondholders, represented by trustee Citicorp International, took over the case when Kaisa failed to repay a US$750 million bond, according to a September 3 exchange filing.