China Vanke’s US$784 million IPO spin-off attracts Temasek, UBS, hedge funds as cornerstone investors

- Six cornerstone investors including Temasek and global hedge funds will sign up for 35.8 per cent of the IPO shares, or 3.5 per cent of the company’s equity

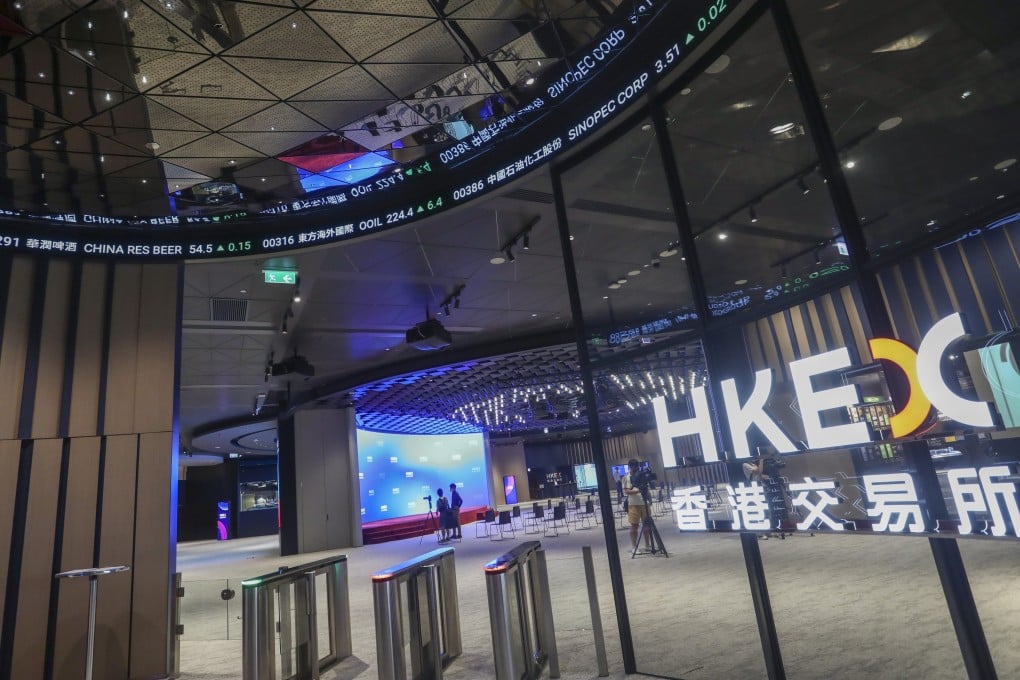

- Onewo is due to price its Hong Kong IPO shares on September 22 and starts trading on September 29, according to indicative timetable

The Shenzhen-based developer is seeking to raise as much as HK$6.15 billion (US$784 million) by selling 116.7 million shares in its unit Onewo Inc, according to a stock exchange filing on Monday. The shares are being marketed at HK$47.10 to HK$52.70 each.

State-owned fund management firm China Chengtong group is anchoring the US$280 million block of purchase by key investors. It has committed to 13.6 million Onewo shares worth HK$725 million at the top-end of the price range. Temasek will take up US$25 million worth of shares while UBS Asset Management unit in Singapore will buy a US$60 million stake.

China Vanke’s ownership in Onewo will drop to 56.6 per cent from 63 per cent after the IPO. Citic Securities, Citigroup and Goldman Sachs are joint sponsors of the stock offering.

Founded in 1992, Onewo has since positioned itself as a so-called “space tech” company two years ago by serving residents mainly through its app Zhuzher, taking on outsourced projects from business and government clients, and building a cloud platform that improves efficiency of property management.

Onewo is coming to the market at a time when risk appetite is waning following a series of rate increases by the Federal Reserve that has raised recession alarm. The Hang Seng Index fell on Monday to the lowest level since mid-March, as traders priced in more than a 75-basis point hike at the Fed policy meeting this week.