Concrete Analysis | Why the Northern Metropolis development strategy won’t lead to a fall in Hong Kong home prices

- The Northern Metropolis, covering an area of 30,000 hectares, envisions some 926,000 residential units accommodating a population of about 2.5 million

- The Northern Metropolis development strategy is expected to take 15 to 20 years to be fully completed

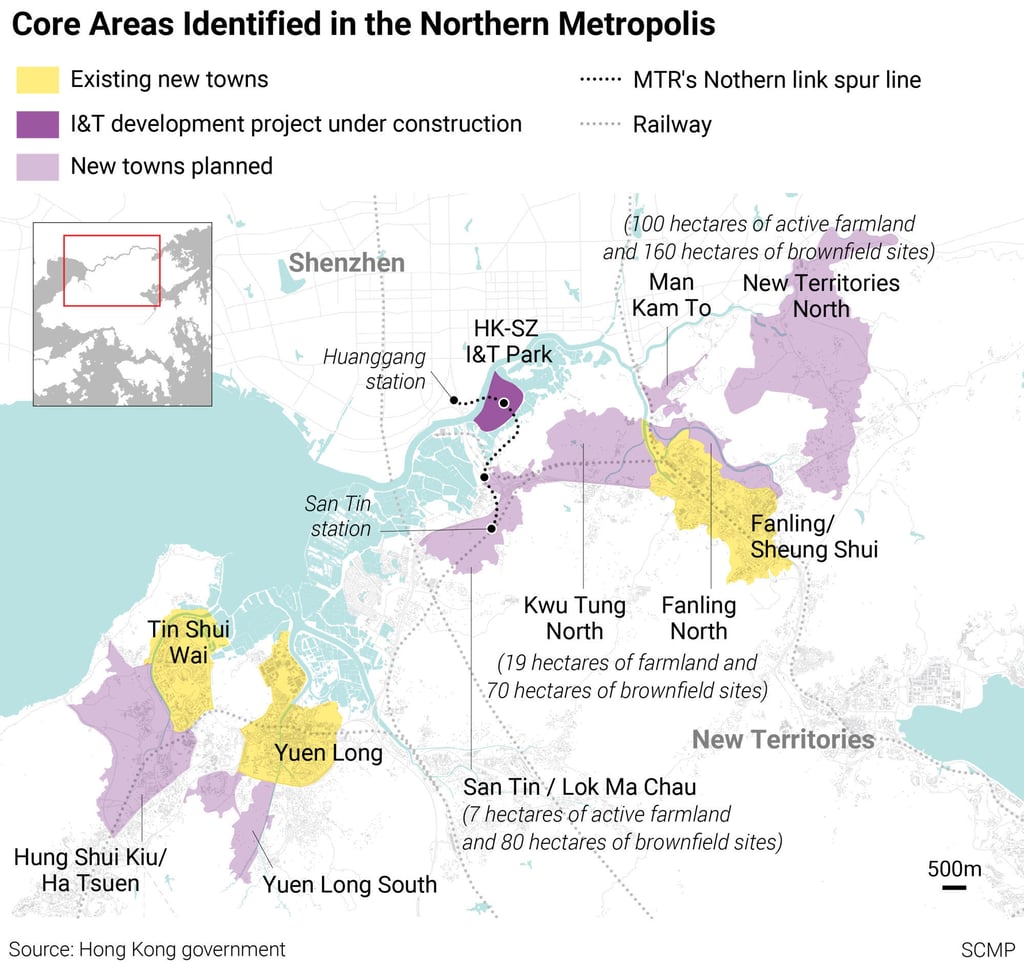

The Northern Metropolis Development Strategy was introduced by Chief Executive Carrie Lam Cheng Yuet-ngor in her Policy Address last year. The Northern Metropolis covers a few mature new towns, as well as some new development areas, including Kwu Tung North, Hung Shui Kiu, San Tin, Lok Ma Chau and Man Kam To, with a total area of about 30,000 hectares.

There are different views on the Northern Metropolis. Prospective buyers with enough savings for a down payment worry that property prices will drop, owing to the enormous projected future supply, and are hesitant about climbing on the property ladder now. University students who have just submitted an application for public rental housing expect to be allocated a public housing unit in the Northern Metropolis immediately after graduation. And existing property owners wonder if they should cash in while property prices are still on the high side.

The question for prospective buyers is why are they considering climbing on the property ladder even when the property prices have been hovering at a historical peak level? Is it because the current low-interest-rate environment prompts them to think that owning a flat will lead to more long-term savings?

Take a HK$5 million (US$640,000) built flat as an example. A buyer could get a 90 per cent loan-to-value (HK$4.5 million) from the bank with an actual mortgage rate of 1.5 per cent. The monthly mortgage repayment is about HK$16,000, of which only HK$5,000 is interest. Would you choose to buy a flat and invest HK$11,000 per month in long-term savings or pay a monthly rent of over HK$10,000 as expenses? The Northern Metropolis has no impact on such a decision.

A question for university students is why are they queuing for public rental housing so early. Are they worried that the price of private housing will continue to surge and that their income after graduation will not keep up with housing price growth? Property prices have not risen as much in recent years, with several stamp duties currently in place. The average price increase in the past three years is on par with inflation. And it could take more than a decade for public housing in the Northern Metropolis to be completed.