Hong Kong’s home prices to fall in 2022 as stock market slump creates ‘negative wealth effect’, Morgan Stanley says, marking a halt in city’s decade-long real estate bull run

- Morgan Stanley expects Hong Kong’s 2022 home prices to fall by 2 per cent, going against the market’s consensus of gains between 3 and 10 per cent

- Sales volume of lived-in homes may contract by 15 per cent next year, in a drastic retreat from the 29 per cent surge in the first 11 months of this year, the bank said

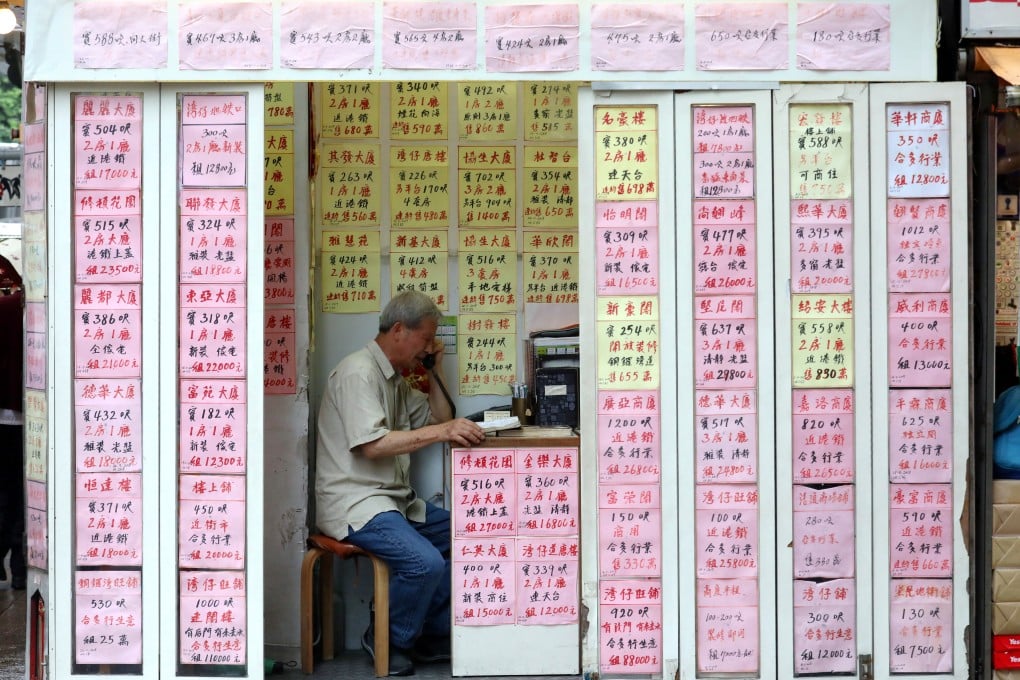

The prices of Hong Kong’s lived-in homes may decline in 2022, reversing 13 years of gains, as a plunge in the stock market has created a “negative wealth effect” on investors and speculators, Morgan Stanley said.

Overall prices may fall by 2 per cent next year, the US bank’s equity analyst Praveen Choudhary wrote in a December 15 report, going against the market’s consensus for prices to gain by between 3 per cent and up to 10 per cent.

Sales volume of lived-in homes may contract by 15 per cent next year in the secondary market, in a drastic retreat from the 29 per cent surge in the first 11 months of this year, he said. Transactions of newly built homes may shrink by 5 per cent next year, compared with the 24-per cent growth so far this year.

The contrarian forecast was the result of the 18 per cent slump in the Hang Seng stock benchmark since July 1 – the world’s second-biggest loser this year – that “suggests a negative wealth effect which has historically resulted in a decline in property prices,” he wrote.

As a result, property-related stocks may perform worse than even the Hang Seng Index (HSI) in 2022, Morgan Stanley said, downgrading its view on the sector to “cautious” from “attractive.”