Advisers differentiate services as more banks expand wealth-protection strategies for China's ultra-rich

Advisers are adapting their service to Chinese investors who have increasingly sophisticated plans for international expansion

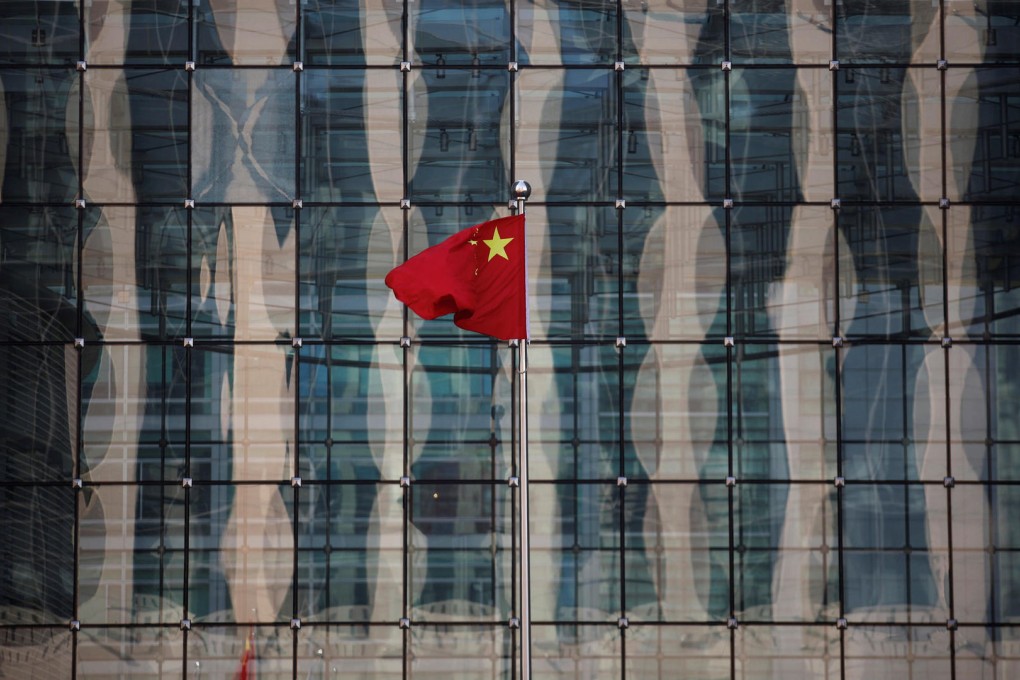

The phenomenal growth of mainland China's asset-owning class has created a vast pool of potential investors looking for means and methods to diversify their holdings outside the mainland.

For overseas-based private banks, this presents a spine-tingling opportunity. But with it comes a need for sure-footed strategies and an awareness that mainland banks, with their increasing sophistication and plans for international expansion, are not going to sit idly by while others muscle in on such a lucrative slice of the market.

"Competition is keen," says Francis Liu, UBS Wealth Management's Greater China regional market manager for UHNW (ultra-high-net-worth) clients. "The Chinese banks with a presence in Hong Kong are building their international product and service platform. Some have a very well-structured form of private banking services, which is increasing client awareness about being not just home buyers or only investing in the domestic market."

In reaction to those moves, UBS has geared up its own push for mainland customers and sought to differentiate itself in specific ways.

One is by stressing the bank's research-based investment advice, due diligence, and robust internal controls regarding any recommendations made. Another is its commitment to training frontline staff to understand and rationalise client needs. A third is offering a built-in alert system on the digital platform to ensure clients know, for instance, when an oil stock drops below a target price.

"We want to sell the ability to put money [to] work in global markets," Liu says. "In general, mainland banks are more familiar with the hot stocks in China, but we can educate clients to look at themes that will gain from growth internationally, asset allocation models, and risk/reward considerations. If a client already has investments in China, we will only focus on other areas that require our support."

For prospective mainland-based customers, a key concern in uncertain economic times is wealth preservation.