Further mortgage rate rise 'could cut home prices by 20pc in two years'

Homes could lose 15 to 20pc of their value in just two years, investment bank warns, while others think impact will be less severe

Home prices in Hong Kong may fall by 15 to 20 per cent in two years following the increase in mortgage lending rates, an investment bank predicts, but some developers and bankers believe the impact will be small.

Deutsche Bank, which forecast mortgage rates to rise a further 0.75 of a percentage point, said prices could drop by 20 per cent in the coming years.

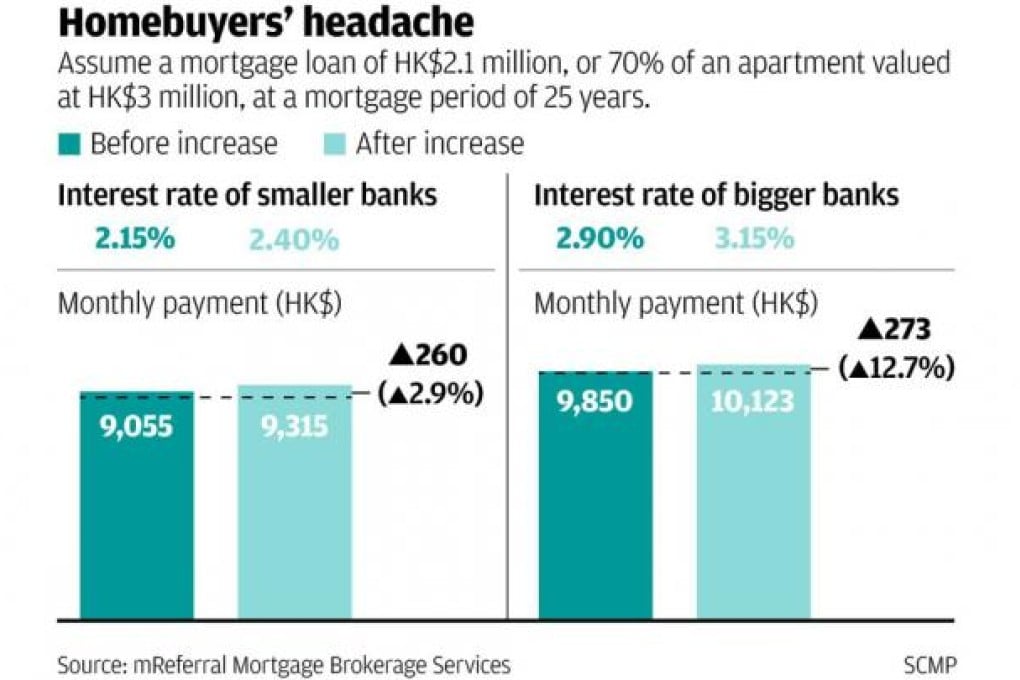

Its prediction came on a day that saw Hang Seng Bank follow HSBC and Standard Chartered in raising its residential mortgage rate on new loans by 0.25 of a percentage point. The bank's best lending rate now ranges between 2.4 and 3 per cent.

Shih Wing-ching, co-founder of Centaline Property, reacted angrily to the rate increase. He questioned if banks were under pressure from the government to raise rates, adding that the move had soured market sentiment.

"[Banks] won't increase mortgage rates to deter buyers from entering the market when there are no customers [anyway]," Shih told Cable TV. "Look at the developers. They offer buyers benefits including help with stamp duty, or even lower prices. There's no reason for banks to do it the other way round."

In a report yesterday, UBS Investment Research said even though the rate increase had a limited financial impact on new mortgagees, it would weaken buyer sentiment in the near term. "We expect developers might now delay launching projects that had been scheduled over the next few weeks," it said.