Advertisement

Advertisement

Deb Price

Senior Editor, Business

Deb joined the Post in 2018. Formerly an editor at The Wall Street Journal and The Washington Post, she was a Harvard Nieman fellow in 2011. She was the lead writer on The Wall Street Journal's digital project, "No Good Choices," which won the top award for excellence in reporting on women's issues from the Society of Publishers in Asia in 2015.

Xiaomi continued to soar after being picked to join the Hang Seng Index. Wuxi Biologics also rose, but Alibaba fell. The new tech index gained.

The three stocks that will be added to the Hang Seng Index on September 7 – Alibaba, Xiaomi and Wuxi Biologics – rose.

“After Ant released their prospectus yesterday, all the market focus was on their listing, boosting up the whole sector valuation, leaving more room for Ant to rise after listing,” said Alan Li, portfolio manager at Ample Capital.

The three stocks that will be added to the Hang Seng Index on September 7 saw mixed results: Alibaba climbed, while Xiaomi and Wuxi Biologics slid.

Advertisement

Tencent and Alibaba got a boost: US companies will be allowed to use Tencent’s WeChat in China and big Alibaba shareholders are swapping their US shares for Hong Kong ones, Bloomberg reports. Meanwhile, one stock debuting on the ChiNext skyrocketed nearly 3,000 per cent.

Xiaomi, Alibaba and Wuxi Biologics join the Hang Seng Index on September 7. Passive fund managers will add them to their holdings. This coming week, Xiaomi reports results on Wednesday. Expect more fireworks, analysts say, after this past week’s rollicking trading.

“All of a sudden, people call us and are ordering silver,” said Pádraig Seif, partner of Precious Metal Asia, a trader based in Hong Kong. “And they're not buying just small quantities. They’re buying a hundred kilos here.”

Next Digital tumbled 41 per cent, after a 1,200 per cent run-up over the previous two days. Its founder was arrested on Monday on suspected violation of the city’s new national security law, sparking a rallying cry to buy his stock.

Zhuhai will be the first city to be issued with tourist visas, says the Macau government, though visas will be halted if there are signs of virus transmissions returning.

Traders have been excited about the new Hang Seng Tech Index, which had run up a 10 per cent gain as of Thursday since its official launch two weeks ago. Now investors are worried Donald Trump’s ire may chill the outlook for some of China’s tech high fliers.

It plans to use much of the US$1.38 billion raised to expand overseas, amid the huge surge in clinical trials for products related to potential vaccines and treatments for the coronavirus.

Tencent fell after US President Donald Trump banned its WeChat app to “protect our national security.” It plunged as much as 10 per cent before closing down 5 per cent.

Overnight, US Secretary of State Mike Pompeo called on US app stores to remove “untrusted” Chinese-owned apps, including WeChat and TikTok. This expanded the US charge against Chinese tech giants over a mix of security and human rights abuse claims. WeChat operator Tencent narrowed early losses.

Gold has surged past the US$2,000 per ounce threshold, setting yet another all-time record as the precious metal continues to benefit from a slew of global risk events.

Tencent is in talks to create a massive US$10 billion video game streaming giant through a merger of Huya and DouYu, according to Bloomberg.

Is there pent-up demand to fly, sit in movie theatres and generally return to the pre-coronavirus world? Or, with the virus now in its seventh month, have consumers moved on, with reliance on all things digital becoming even more hard-wired?

Investors have big hopes for Apple suppliers like Luxshare Precision and GoerTek, both of which have skyrocketed by more than 100 per cent in 2020.

Uncertainty prompted traders to pull money out in both Hong Kong and mainland China. Early positive sentiment was pushed aside by the weight of US-China tensions and rising Covid-19 cases in the city and in parts of the mainland.

Tencent is now the world’s seventh most valuable company, ahead of Facebook, with one analyst expecting the shares to continuing rising over the next 12 months.

Tencent tops Facebook as world’s most valuable social media network. It shot up 4.5 per cent, taking its market capitalisation to nearly US$670 billion, compared to its American rival’s market cap of US$657.83 billion. Tencent became the world’s seventh-largest company.

China ordered the US to close its consulate in Chengdu in retaliation against a similar move against its own consulate in Houston earlier this week. Rising US-China tensions triggered a sell-off in mainland and Hong Kong markets.

Investors are worried that the China and US relationship may get worse, said Kenny Wen, wealth management strategist at Everbright Sun Hung Kai.

Some Chinese are rethinking their transport options and see cars as a safer alternative to buses and subways. “The market is very watchful: Is this a new trend altogether? If it is, then you might see big demand to be more sustainable,” said Alexious Lee of Jefferies.

Bargain hunters snapped up shares in Hong Kong that were dealt a blow on Thursday. Mainland shares turned up in choppy trading. By the close, the benchmarks’ gains were small, indeed, but enough to pump in some reassurance to rattled markets.

Investors are worried that stocks have risen too quickly and that Chinese authorities may put in more cooling measures. Also, they are concerned that stronger-than-expected economic data out Thursday will lead to tighter liquidity in the world’s second-largest economy.

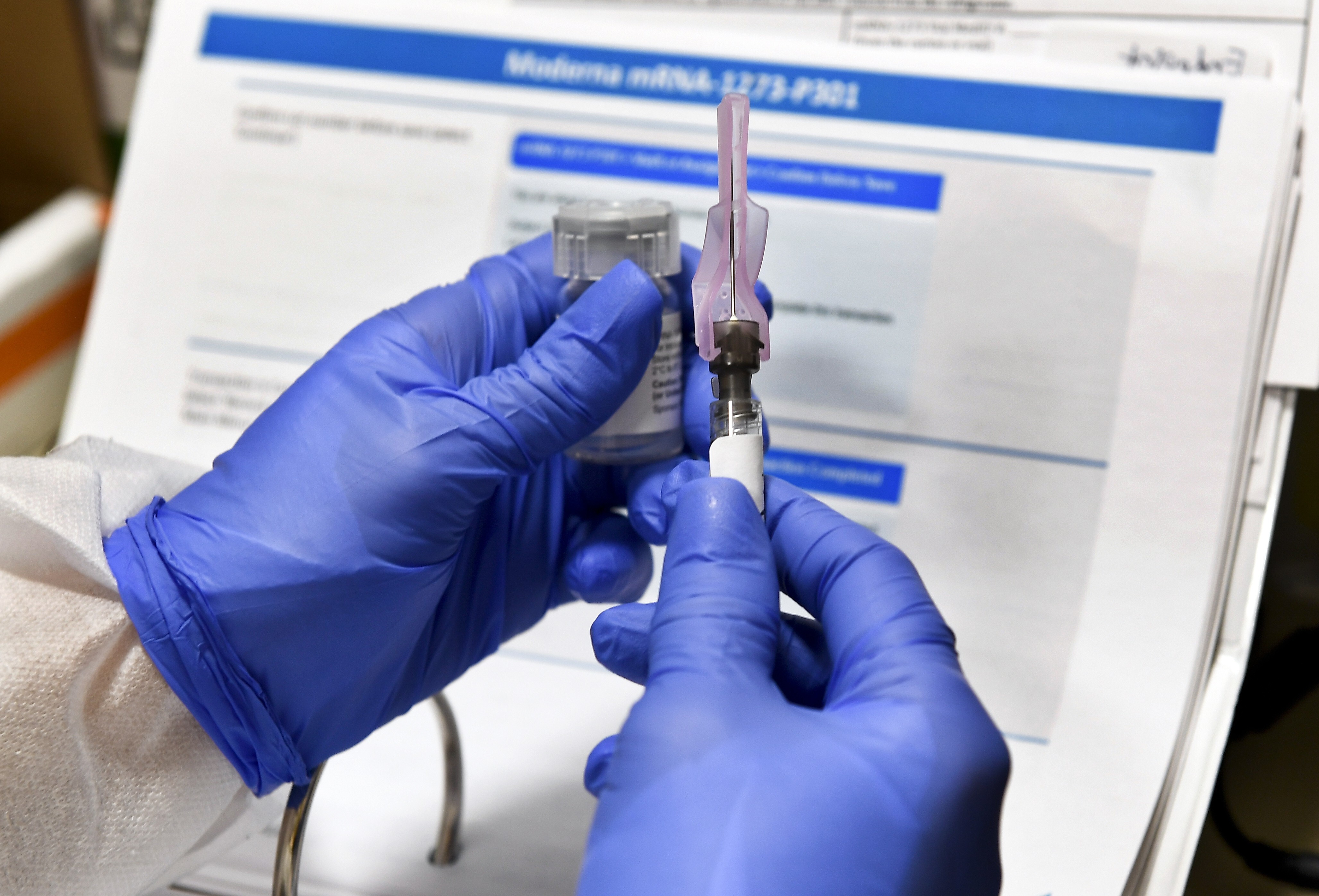

Investors in Hong Kong focused on the spike in Covid-19 cases and progress in a vaccine in trials in the US. The Hang Seng Index eked out a teensy gain – after falling Tuesday.

The step is a move toward the eventual lifting of all restrictions for visitors from the province, who accounted for nearly half of all visitors to Macau last year.

A number of recent high fliers saw profit taking, including Tencent, Alibaba and Meituan Dianping. Casino stocks took off as Guangdong province relaxed travel restrictions for Macau.

Investors in Hong Kong are beginning the second week of the newborn bull market, as mainland money has poured in and a total of 24 initial public offerings are slated for this month. Sentiment overall remains positive.

Investors need to watch out for three big risks: inflation shooting up; interest rates rising; and market sentiment backing a return to normal.