01:52

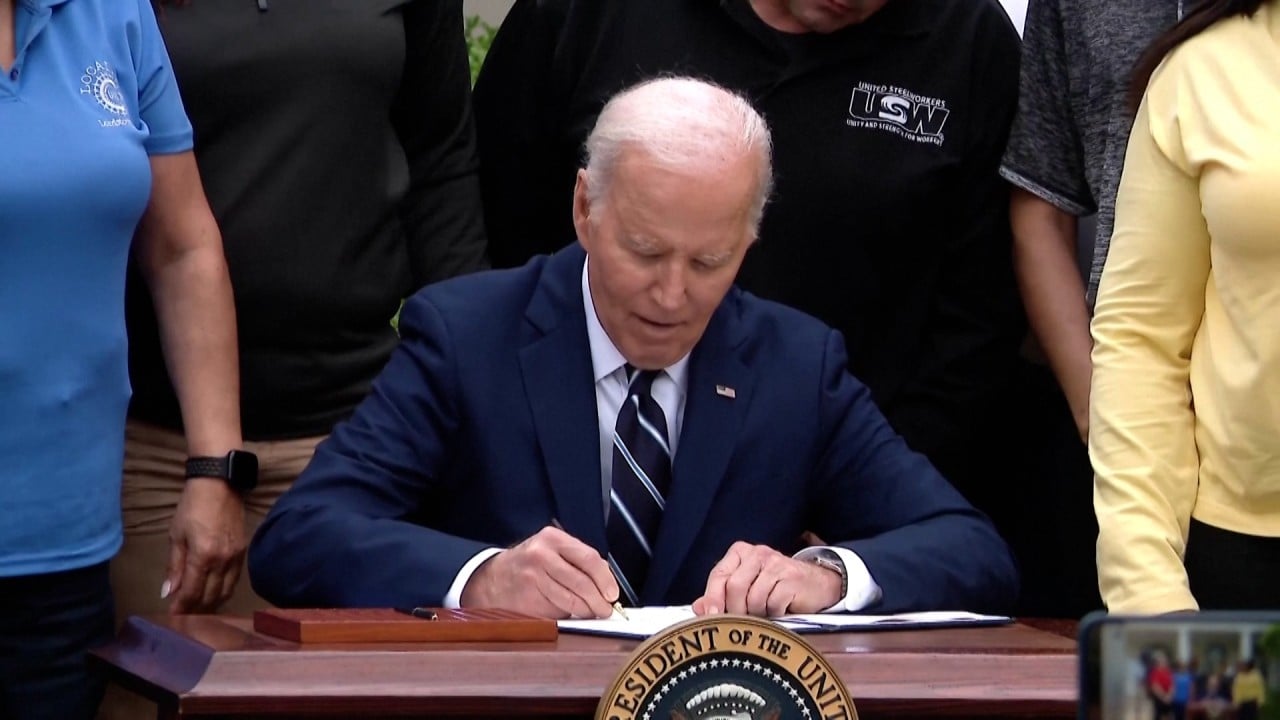

US proposes new round of tariffs on China in latest trade war escalation

US tariffs on China: what’s the real impact, and what could happen next?

- Analysts discuss how Beijing could respond to Washington’s latest trade offensive, and how the impact could have repercussions beyond China’s borders

- Foreign minister implores international community to stand against the US creating ‘new troubles for the world’

US President Joe Biden’s latest tariff increases on Chinese electric vehicles (EVs) and other goods may trigger similar actions from Europe and pace up a reshuffle of crowded industries inside China, according to experts in international relations.

And they expect that Biden’s decision, largely seen as being rooted in political motivations during an election year, could have big ripple effects, leaving China under threat of collective duties from the West amid industrial overcapacity concerns.

Washington’s proposal on Tuesday looks to raise tariffs on Chinese EVs from 27.5 per cent to 100 per cent. Other products affected included solar cells, semiconductors, batteries and aluminium products, with suggested duties ranging from 25-50 per cent.

Instead of immediate, substantial damage to affected sectors, given the relatively small amount of related exports to the US, Chen said “it’s more about the psychological impact – the tendency [for others] to follow suit”.

Wang Yiwei, a professor of international relations at Renmin University in Beijing, agreed that besides winning over voters in an election year, Biden’s latest move also sends a message to Europe, where President Xi Jinping recently paid a visit, that they “should follow us and not embrace China”.

But such an alliance would not be solid, as Europe is already split due to the war in Ukraine, he said. “Nor would the increased duties offset the all-round advantages in China’s new energy industry.”

China’s clean-energy sector has been widely accused of being excessive and flooding other markets with relatively cheaper goods thanks to government subsidies. Beijing has repeatedly denied such claims, calling them an excuse to pursue trade protectionism.

Speaking to the press on Wednesday after meeting in Beijing with Pakistan’s deputy prime minister, Chinese foreign minister Wang Yi touched on Washington’s repeated sanctions, including its latest tariff-hike proposal, saying the actions represent “the most typical bullying in the world today”.

And noting that such moves are forms of unilateralism and protectionism, he said: “At this critical moment of global economic recovery, the international community should warn the US not to create new troubles for the world.”

If [the US] doesn’t start early in containing China, China would definitely hold a significant share of the American market in the future

“It’s true that we have some overcapacity for ourselves,” Chen said, adding that she expects more mergers and acquisitions to take place in new-energy industries as pressure from the West mounts.

“We must select the fittest and eliminate the weak ones. Those that are capable of going overseas should go,” she said, suggesting destinations such as Africa.

Washington’s new tariffs could also mark the start of a long-term strategy to contain China’s new-energy industry, starting with tariffs on complete vehicles and on upstream products later, said Zang Chengwei, a researcher specialising in international trade at the Institute of World Economics and Politics under the Chinese Academy of Social Sciences.

According to Tuesday’s announcement, the proposed tariffs for natural graphite and permanent magnets would not be enforced until 2026.

“Although China isn’t exporting a huge amount of new-energy products to the US, it’s a great amount when it comes to total exports to the world,” Zang said, adding that China enjoys cost advantages in those categories compared with the US and Europe.

“If [the US] doesn’t start early in containing China, China would definitely hold a significant share of the American market in the future,” he said.

Meanwhile, not all American companies are welcoming the new tariffs, with some fearing that the added costs could make it harder to compete in the US and abroad, according to the US-China Business Council, a non-profit organisation of 270 American companies that do business in China.

Given that prior tariffs have not sufficiently addressed concerns about China’s unfair market practices, “it is unclear how continuing those and piling more tariffs on will be any more effective”, the council’s president, Craig Allen, said in a statement on Wednesday.

“Additionally, levying new tariffs invites retaliation from China, which combined could further disadvantage US companies selling goods and services in China’s market, compared with their foreign competitors,” he said.

Options for China to fight back are rather limited, according to Donald Low, a senior lecturer and professor of practice with the Institute for Public Policy at the Hong Kong University of Science and Technology.

“It can increase its tariffs on US goods, but if those are hi-tech goods, this might hurt China’s efforts in technology upgrading,” he said, adding that if tariffs were increased on low-tech goods – like those used in agriculture – it would simply induce Chinese consumers to switch to similar goods from other countries.

Presumably, China could increase subsidies to those industries affected by the new tariffs, he explained, “but to the extent that such industries are already subsidised, doing so is not just costly, it might cause other countries to introduce similar, countervailing tariffs on Chinese imports”.

Additional reporting by Sophie Chew